Business Accounting Worksheets Results

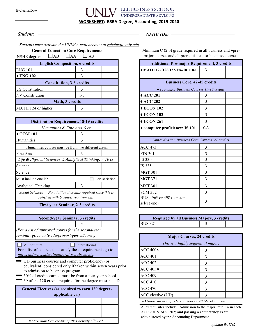

WORKSHEET: BSBA Degree, Accounting, 2019-2020 - University of Nevada ...

satisfied with business requirements. BUS 496* or 498 (capstone; select one) 3 First-year Seminar, 2-3 credits Humanities & Fine Arts, 9 cr. WORKSHEET: BSBA Degree, Accounting, 2019-2020 General Education Core Requirements Minimum C (2.0) grade required in all business and ♦pre-major courses and all prerequisites for business courses.

https://url.theworksheets.com/3fs123 Downloads

Preview and Download !

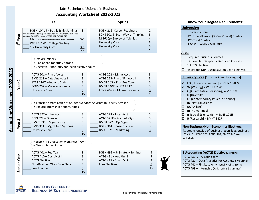

Jabs Bachelor Science Business Accounting Worksheet 2022 2023

Non ‐Business/Non EconomicsElectives: 48 credits outside of business, econ & ag business (ECNS 101, ECNS 202, ECNS 204, BMGT 240 are included). University [1Core course in eachcategory] US [University Seminar] = BGEN 104US W [Writing] = WRIT 101W

https://url.theworksheets.com/5r2h61 Downloads

Preview and Download !

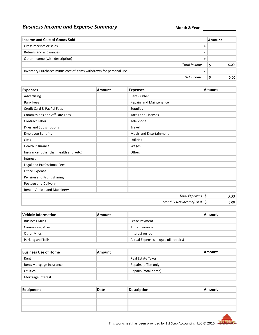

Business Income and Expense Summary Month & Year - 1st Step Accounting, LLC

Total COST paid for prepared foods while on business travel (accountant will figure 50% of this amount to write off) Utilities Total COST of utilities not paid for a home office (gas, electric, water, sewer, garbage, internet, security)

https://url.theworksheets.com/1gm8257 Downloads

Preview and Download !

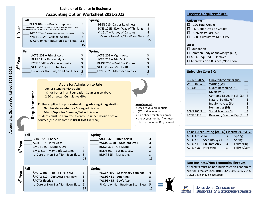

Bachelor Science Business: Accounting Option Worksheet 2021 2022

Jabs Residency Policy: Of the upper‐division credits required for business students, at least 18 credits and BGEN 499 (4 credits) must be taken in residence at the Jabs (not transferred from another ins tu on). Ques ons? Need Help? Jabs Office of Student Services business@montana.edu 406‐994‐4681 Jabs Hall Room 124

https://url.theworksheets.com/2v7i119 Downloads

Preview and Download !

Bachelor of Science in Business: Accounting Option Worksheet 2020-2021

54 credits Non-Business/Non-Econ Fall ____BGEN104US – Bus & Eship Fund 3 ***Students transferring into Jabs who have already earned US credit must take BGEN 204 instead of BGEN 104US ____ ECNS 101IS – Econ Way of Thinking 3 ____ U-Core or Non-Bus/Non-Econ Elecs 9 15 Take 1 Accounting (ACTG) Elective (3 credits):

https://url.theworksheets.com/b2a111 Downloads

Preview and Download !

Lee Business School WORKSHEET: BSBA Degree, Accounting, 2014-2015

♦ Admission to the major required to enroll in upper-division business courses. ♦ Lee Business School's Course-Repeat Policy: Students may take business courses a maximum of three times for degree applicability. For upper-division accounting (300-400-level ACC) classes, the three attempts include: grades earned, withdrawals and audits.

https://url.theworksheets.com/4mlg61 Downloads

Preview and Download !

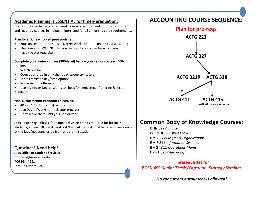

Business Majors Curriculum Worksheet (2018-19)

NOTE: Curriculum worksheets are supplemental planning aids. Every effort is made to ensure accuracy; however, it is the ... 3 ACCT 3990 Internship in Accounting. 7 . or . 3 Business Req. 8,10 _____ 3 ACCT 4100 Contemporary Reporting & Mgt. Control Systems 3 MGT 4150 Business Strategy. 9 . 3 Business Req. ...

https://url.theworksheets.com/5r2i87 Downloads

Preview and Download !

Bachelor Science Business: Accounting Option Worksheet 2014

Bachelor of Science in Business: Accounting Option Worksheet 2014 ‐2015 ... - Any upper-division required business or business option course(s) in which a student earns an unsatisfactory grade (D+, D, D-, or F) must be repeated at MSU-Bozeman. A transfer course may not be used to fulfill a degree requirement in which a student earned an ...

https://url.theworksheets.com/6dj361 Downloads

Preview and Download !

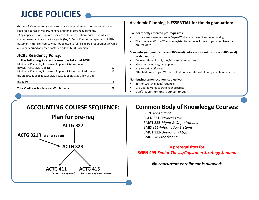

Bachelor of Science in Business: Accounting Option Worksheet 2017‐2018

Accounting Option Worksheet 2017‐2018 University: 120 Total Credits 42 Upper‐Division Credits University Core 2.0 2.00 Cumulative MSU GPA JJCBE: Pre‐Business Common Body of Knowledge (CBK) ACTG Required & Electives 54 credits Non Business/Non Econ

https://url.theworksheets.com/6dj265 Downloads

Preview and Download !

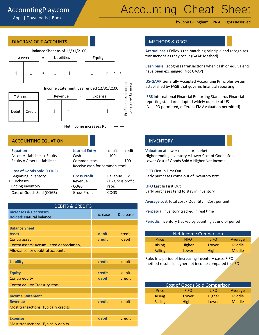

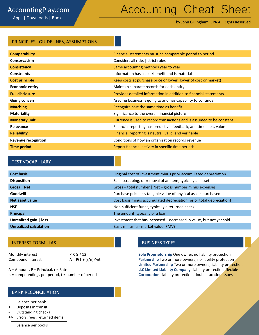

Accounting Cheat Sheet

Mechanics Reports the business activity for a specific period of time and results in net income or loss, which gets recorded to retained earnings at the end of the accounting period REVENUE AND EXPENSE Revenue recognition Recognize (book into accounting record) revenue when it is earned and realizable

https://url.theworksheets.com/3axo663 Downloads

Preview and Download !

Next results >>